Podcast: Play in new window | Download | Embed

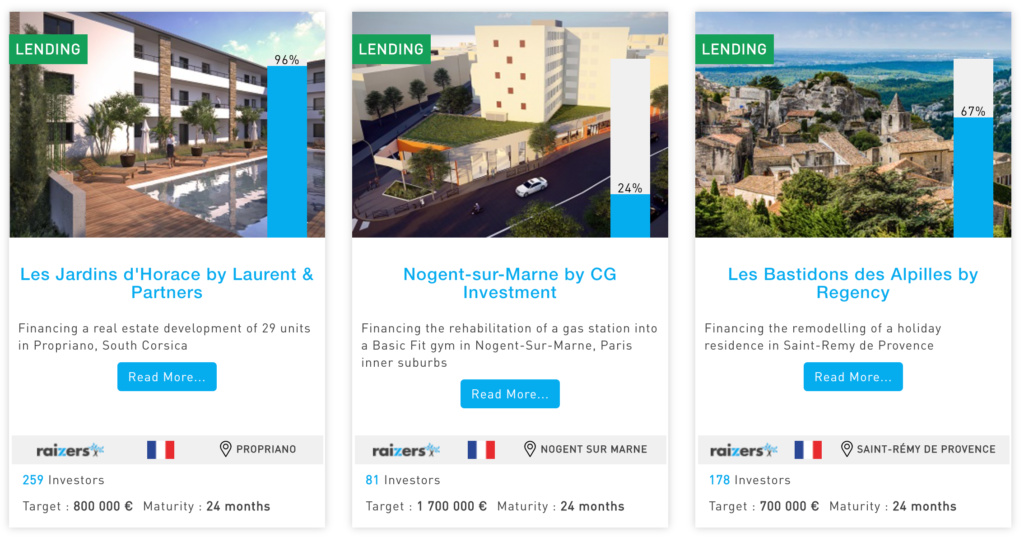

In today’s episode, we interview Maxime Pallain, the co-founder and CEO of Raizers. Raizers is a real estate crowdfunding platform that currently offers several investment opportunities in France.

Raizers’ competitors when it started were private banks, family offices etc. Raizers’ innovation was in digitizing the way to give loans to entrepreneurs.

This platform offers loans to real estate developers, with a maximum 24 months and average of 21 months.

There is currently a 0% default rate on Raizers, and there aren’t any long-pending projects either.

They have financed over 500m in projects. In 2020, they have financed 52 companies with the help of 4 internal analysts (from big four and other important firms in the real estate and finance space, including venture capital funds) and 1 lawyer. This works out at one deal per analyst per month. I’m mentioning this to show that approving projects is not an automatic thing and requires a lot of work. Many proposals are dropped quickly after being received. For example, Raizers will not accept any development project if they don’t yet have the permit to build. In the end, only 10-15% are selected and forwarded to investors for consideration.

Raizers is very serious about debt collection if the need arises. All mortgages are first rank and there is personal liability as well.

Why do borrowers raise money via Raizers? One would say that if you can get a loan at the bank and you come to Raizers there is something strange, since the interest is higher. So that’s the first question asked if a client tries to borrow and avoid the banks outright.

Speed is typically one of the main reasons for skipping the banks, as the banks take way longer than platforms like Raizers. If everything is going well Raizers can give the money in 1 month, while with banks it would take 3-6 months. If you want to buy a building and you have a tight deadline for getting a great deal, the bank option would not be feasible. Another point is that as a borrower, you can repay the loan before, and you have additional fees like the initial fee and the exit fee at the end. So it might work out cheaper in the end for a borrower to use Raizers.

The minimum investment is 1000 euro and you need to pass a suitability test first. Raizers is not trying to find gullible and inexperienced investors and trying to attract them via ridiculously low minimum investments as other platforms do.

Raizers does not withhold any taxes for you. You can read more about taxation of P2P lending in my post on the subject.

In 2021, we might see Raizers offering the opportunity for investors to invest in the platform itself. This is something that other platforms have done in recent months, and it might be a good investment to consider.

We really enjoyed this conversation; Maxime proved to be very knowledgeable and open, and we’re impressed with this platform.